Faulkner County Assessor – Krissy Lewis

Phone: 501-450-4905

FAX: 501-450-4908

Office Hours:

8:00AM – 4:30PM Monday – Friday. Except Holidays

Office Address:

806 Faulkner Street.

Conway, AR 72034

Mailing Address:

801 Locust Ave.

Conway, AR 72034

For Tax Statement Inquiries

contact the Tax Collector

Sherry Koonce at 501-450-4921

skoonce@conwaycorp.net

Commercial Personal Property

Assessments are required of all taxpayers engaged in any kind of business.

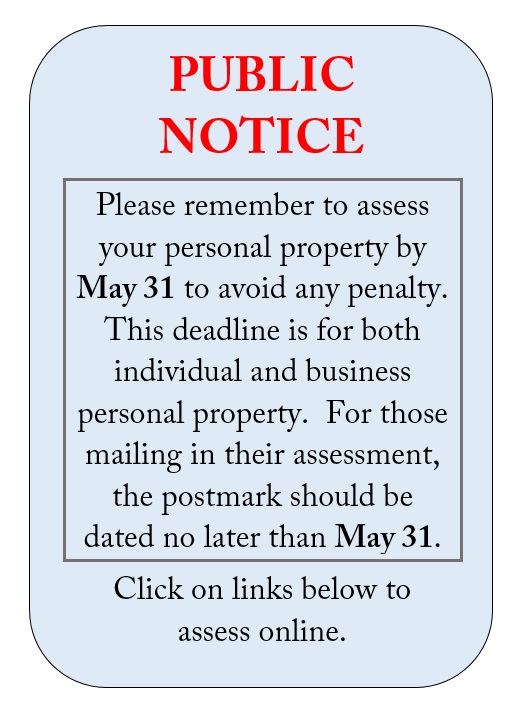

Arkansas statutes require businesses to assess all personal property including, but not limited to, furniture, fixtures, machinery, equipment, inventories, supplies, vehicles, and aircraft, NO LATER THAN MAY 31, of each year. After this date, a 10% penalty will be applied. Commercial Personal Property can not be assessed by phone. Below are the Commercial Property forms. (FORMS MUST BE SIGNED)

Commercial Property Assessment Information

Commercial Property Assessment Form

Commercial Property Assessment Instructions

For questions about Commercial Personal Property please contact Sharon Clack or Nicki Evans at 501-450-4905 ext. 1242 –

or email sharon.clack@faulknercountyar.org or nicki.evans@faulknercountyar.org

Real Estate

The real estate records are available for research by the public. Public access computers are available in the real estate department. Online access to the real estate records is available at www.ARCountyData.com and www.actdatascout.com. This is a free site as well as a fee site. The records on this web site are updated on a monthly basis.

Amendment 79 of the Arkansas constitution provides an up to $600 homestead credit on the property taxes of a property owner’s principle place of residence. Amendment 79 also provides home owners who are 65 and older or who are totally disabled a possible freeze on the taxable value of their principle place of residence.

The deadline to apply for the Homestead Credit on your current tax bill is OCTOBER 15th.

Homestead Credit Application (Spanish)

Counties in Arkansas are required to conduct county wide reappraisals every four years. Currently Faulkner County is in a reappraisal cycle that will be completed in 2028.

GIS Data can be downloaded from the Arkansas Geographic Information Office geospatial portal, GeoStor (www.gis.arkansas.gov) at no charge utilizing their site. To find the county polygon and point layers use the keyword search ‘CAMP’, and the layers will be listed as ‘Parcel Centroid-County Assessor Mapping Program (point)’ and ‘Parcel Polygon-County Assessor Mapping Program (polygon)’.

Personal Property

Personal property is assessed annually by the property owner. The time frame to assess personal property is from the first working day in January to May 31. You can assess personal property in person, by phone, by mail or by fax. Assessments by telephone will not be taken for the initial listing of personal property being assessed to an individual who has no previous assessment on record with the assessor (first-time assessments and new residents, for example). May 31 is the deadline to assess personal property. By state law, a 10% penalty is applied to property not assessed by the deadline.

Assess Online

Other Helpful Links

FAQ: http://www.arkansas.gov/acd/faqs.html